Purchase Order Financing

What is Purchase Order Financing?

Many suppliers are unable to fulfil large orders due to cash flow constraints.

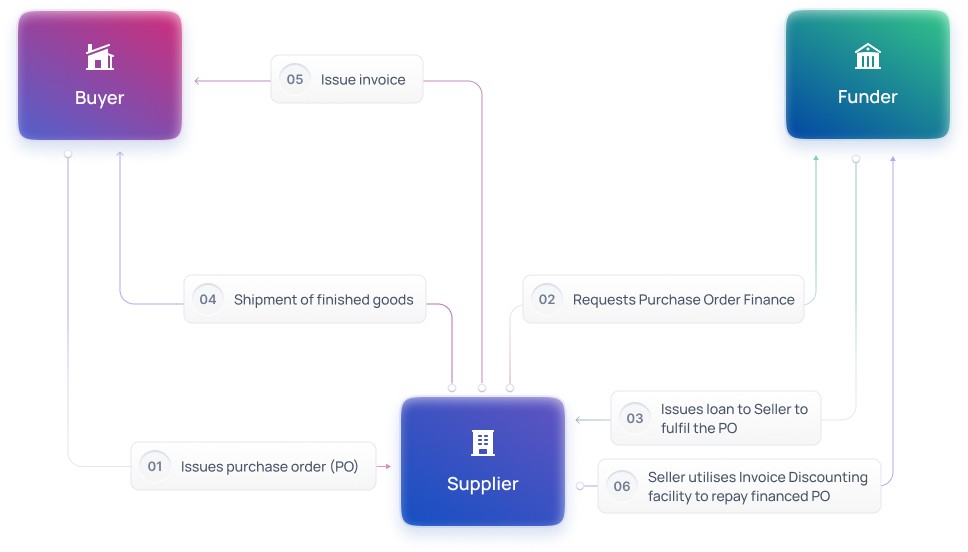

With Purchase Order (PO) Financing, a funder will loan a supplier up to 100% of the costs required to produce and deliver the agreed-upon goods to the buyer. The financing is repaid upon invoice date/delivery of goods by the supplier, typically drawing down on an Invoice Discounting programme.

PO Financing helps suppliers grow their business by enabling them to accept larger orders they would otherwise have to turn down due to lack of funds.

How it works

Funders can…

Unlock new revenue streams by funding earlier in the trade cycle

Strengthen relationships between clients, their customers & suppliers

Buyers can…

Gain greater confidence the supplier can deliver orders

Suppliers can...

Fulfil orders and maxmise sales

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale PO Financing.

There are no complicated manual processes for funders, buyers or suppliers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.