Payables Finance

What is Payables Finance?

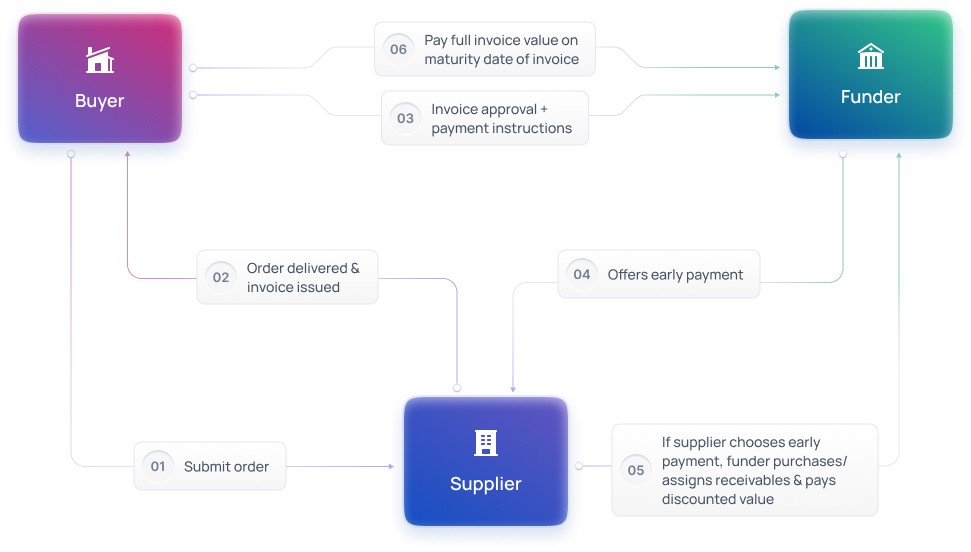

Payables Finance – or Reverse Factoring – lets buyers offer an early payment option to their suppliers based on approved invoices.

Suppliers sell/reassign the invoices to a third-party funder in exchange for a discounted early payment. Buyers then pay the full invoice value to the third-party funder on maturity date - typically under an Irrevocable Payment Undertaking.

Linking a buyer, their supplier, and a funder, Payables Finance reduces the corporate’s supply chain risk and expands the supplier’s finance options.

How it works

Funders can...

Offer short-term finance based on an irrevocable payment undertaking

Attract & retain key clients with flexible working capital products

Buyers can...

Strengthen & grow relationships with all – not just key – suppliers

Extend payment terms & improve commercial terms

Suppliers can...

Access cheaper financing vs self-finance options

Optimise working capital

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Payables Finance.

There are no complicated manual processes for funders, buyers or suppliers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.