Invoice Discounting

What is Invoice Discounting?

When companies sell goods or services to customers, they often do so by extending credit. For some suppliers, this delay results in liquidity issues.

Invoice Discounting reduces the gap between issuing an invoice for delivered goods and receiving payment by unlocking early payments for the supplier.

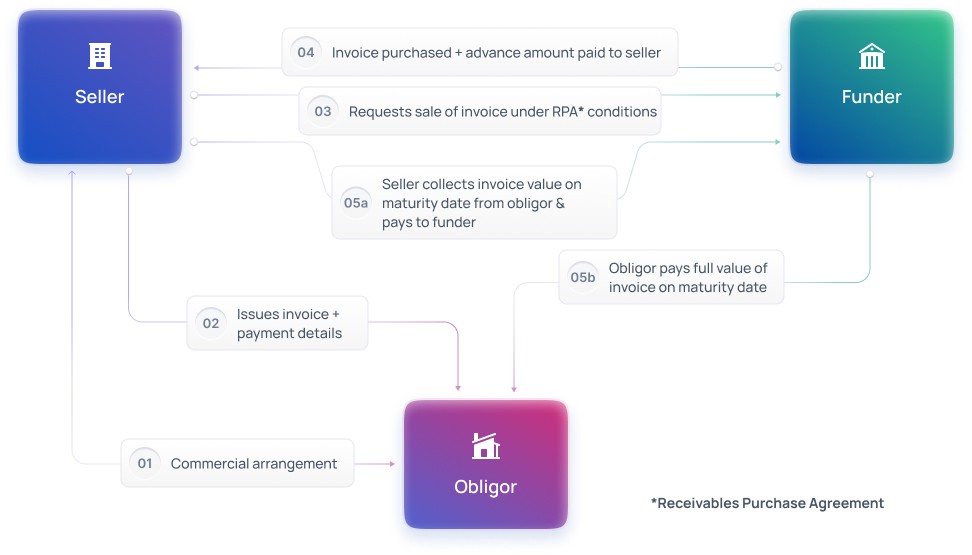

A supplier – often called the seller – sells/reassigns their invoices to a third-party at a discount, in exchange for an immediate payment.

In Invoice Discounting, the seller typically manages the debt management and cash collection process.

How it works

Funders can…

Take credit exposure with a lower risk profile than a loan

Finance invoices from selected debtors, currencies & tenors

Sellers can...

Access cheaper financing

Optimise working capital

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Invoice Discounting.

There are no complicated manual processes for funders, buyers or sellers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.