Factoring

What is Factoring?

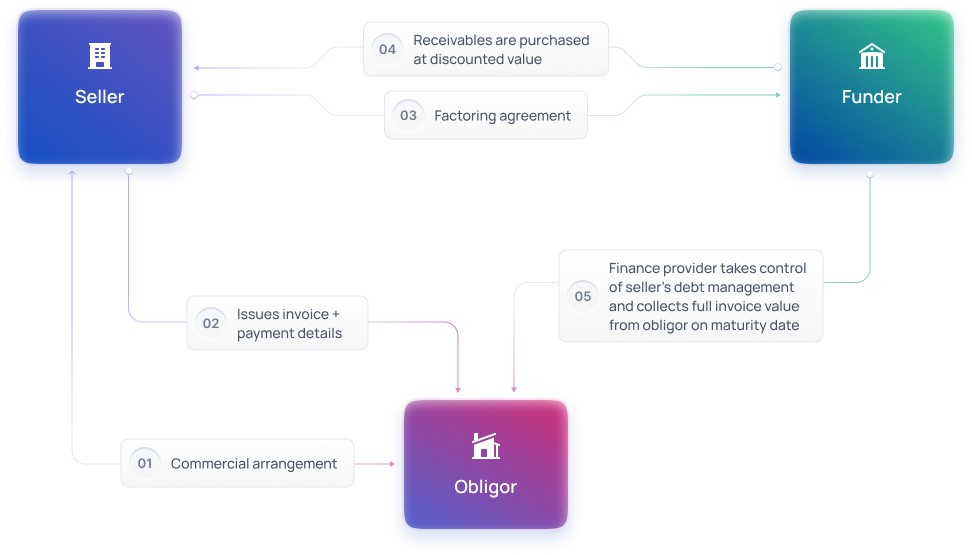

Factoring is the process of selling outstanding invoices to a third-party funder, known as the ‘Factor’.

The seller typically sells their whole book of receivables at a discounted rate. The factor is then responsible for debt management and payment collection.

How it works

Funders can…

Attract and retain key clients

Sellers can...

Optimise working capital

Outsource debt management & payment collection

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Factoring.

There are no complicated manual processes for funders or sellers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.