Dynamic Discounting

What is Dynamic Discounting?

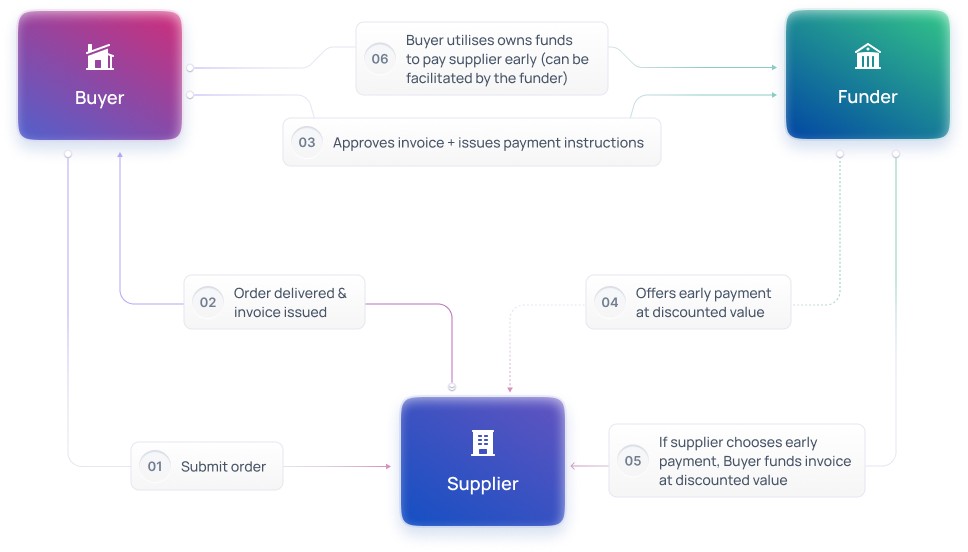

Suppliers of the buyer are paid early, with the buyer utilising their own cash to settle invoices at a discount.

Dynamic Discounting strengthens both parties, not to mention further relationships throughout the supply chain. Buyers gain a positive P&L impact through the early payment discount, while suppliers benefit from early receipt of their receivables.

Unlike Payables Finance, which relies on a funder, the buyer uses their own cash to finance early payment. While funders do not provide the financing, they can empower buyers by providing the programme infrastructure and the financing to suppliers outside of the buyer’s Dynamic Discounting programme.

How it works

Funders can…

Empower clients by providing the programme infrastructure

Enhance buyer programme by financing out-of-scope suppliers

Buyers can…

Reduce profit & loss impact

Exercise option when cash is available

Suppliers can...

Optimise working capital

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Dynamic Discounting.

There are no complicated manual processes for funders, buyers or suppliers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.