Distributor Finance

What is Distributor Finance?

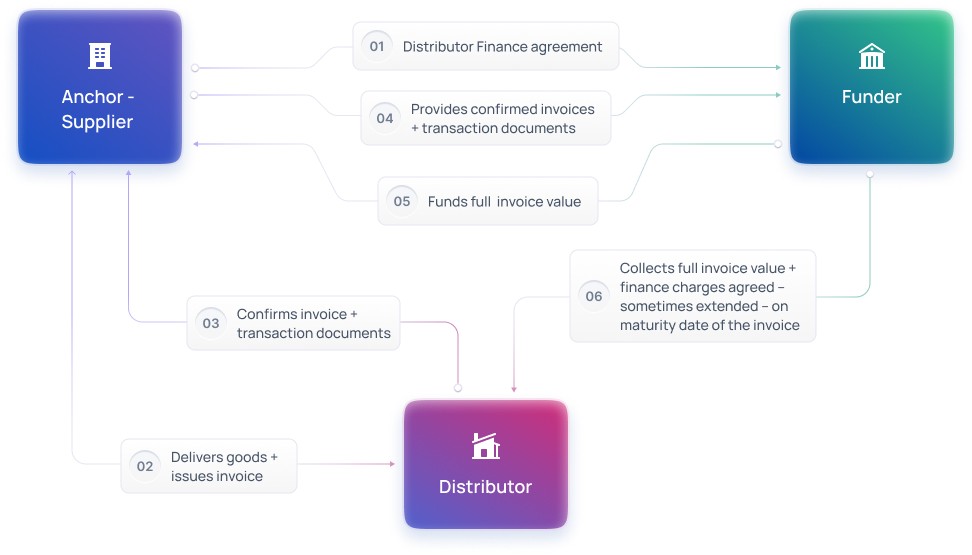

Distributor Finance, sometimes called Channel Finance, is the provision of financing for distributors of a large anchor supplier (manufacturer or a larger distributor) to cover working capital needs arising from the resale of goods.

The facility enables distributors to access working capital by drawing funding under extended payment terms between the anchor and distributors until they have resold the goods and converted receivables to cash. In effect, it’s a combination of Invoice Discounting to the anchor supplier and Payables Extension to the distributor.

Distributor finance benefits the whole supply chain. The anchor supplier can grow sales without taking additional credit risk on partners, while distributors can utilise the additional liquidity to increase purchasing power and subsequent sales revenue.

How it works

Funders can…

Support the process & generate revenue from anchor-supplier & distributor clients

Support greater oversight and process monitoring vs an overdraft

Distributors can...

Maximise sales to clients

Anchor suppliers can...

Grow sales without additional credit risk

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Distributor Finance.

There are no complicated manual processes for funders, buyers or suppliers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.