Corporate Payment Undertaking

What is Corporate Payment Undertaking?

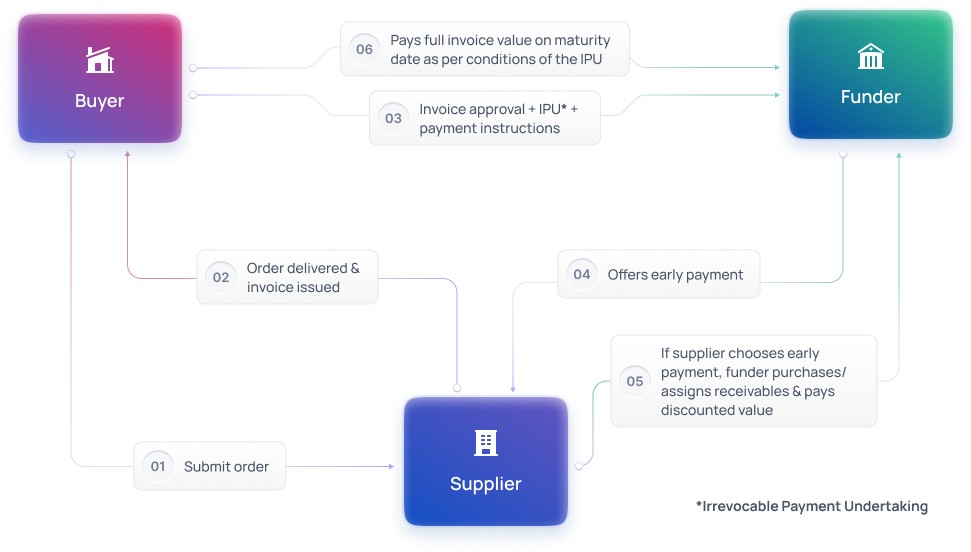

Corporate Payment Undertaking – or Prepayment – gives suppliers the option to receive discounted payment early, provided the buyer has issued a Corporate Payment Undertaking to a third-party funder.

If suppliers request early payment on invoices from the buyer, the third-party funder can make that payment. The buyer settles the maturity payment outlined in the Corporate Payment Undertaking programme.

Linking buyer, supplier, and funder, suppliers can access & funders can offer working capital financing based on a buyer’s Corporate Payment Undertaking programme.

How it works

Funders can…

Expands on existing products to strengthen client’s supply chain

Engage in conversations with new prospects

Buyers can…

Outsource accounts payable department to a third-party funder

Optimise liquidity by securing favourable payment & commercial terms

Suppliers can…

Access cheaper financing

Improve relationship with buyer

Why choose Finverity?

Our technology, FinverityOS, makes it easy to build, manage and scale Corporate Payment Undertaking.

There are no complicated manual processes for funders, buyers or suppliers, and no restrictive limits on what you can do.

Replace outdated, fragmented systems and deliver more revenue, more efficiency, more flexibility with a single digital system for all supply chain finance products.